If you’re a real estate investor, self-employed, or have non-traditional income, you know how frustrating it can be to qualify for a loan. Traditional lenders want to see W-2s, tax returns, and years of financial history, making it difficult for stated income borrowers to secure financing.

But what if there was a way to qualify for a mortgage without handing over stacks of personal income documents?

Enter EDSCR-based loans—a game-changing financing option that focuses on your rental property’s income, not your personal earnings. Whether you’re an entrepreneur, freelancer, or investor building a real estate portfolio, this type of loan could be the key to unlocking more deals and growing your wealth.

What Is an EDSCR Loan?

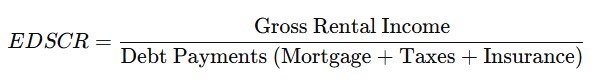

An EDSCR loan (Economic Debt Service Coverage Ratio loan) is a type of no-income verification mortgage that allows borrowers to qualify based on rental income rather than personal income.

Instead of looking at W-2s, pay stubs, or tax returns, lenders use the Debt Service Coverage Ratio (DSCR) to determine loan eligibility. This ratio measures whether the property’s rental income can cover its debt payments.

✔ If the ratio is 1.0 or higher, it means the property generates enough income to cover the mortgage—making you a strong candidate for an EDSCR loan.

✔ If the ratio is below 1.0, the property may not generate enough cash flow, and lenders might require a higher down payment or additional reserves.

This approach makes EDSCR loans ideal for stated income borrowers, real estate investors, and self-employed individuals who don’t have traditional income documentation.

Why Stated Income Borrowers Should Consider EDSCR Loans

✅ 1. No Personal Income Verification Required

Unlike traditional mortgages that require years of tax returns, W-2s, and proof of steady employment, EDSCR loans focus only on the property’s income.

That means:

- No need to prove your personal income.

- No tax return or W-2 headaches.

- No worries if your tax deductions lower your reported income.

👉 Bottom Line: If your rental income is strong, you can qualify—no W-2s needed.

✅ 2. Easier Approval Process for Self-Employed & Investors

Traditional lenders often reject self-employed borrowers because their income fluctuates, or they write off too many expenses on their taxes.

With an EDSCR-based loan, your personal income doesn’t matter—lenders only care if your rental property cash flows well.

✔ Ideal for entrepreneurs, freelancers, business owners, and investors who don’t have traditional pay stubs.

✔ Perfect for investors who use tax write-offs to reduce taxable income.

✔ Eliminates the need to explain irregular income patterns.

👉 Bottom Line: If you own a profitable rental, lenders care about the property’s earnings, not your personal financials.

✅ 3. Perfect for Scaling Your Real Estate Portfolio

If you’re trying to grow your real estate business, traditional mortgages can slow you down. Many banks limit the number of mortgages you can hold or require personal debt-to-income (DTI) calculations, making it harder to qualify for multiple loans.

With EDSCR-based financing:

✔ Your DTI ratio doesn’t matter—only rental income is evaluated.

✔ There’s no limit on the number of loans you can take out.

✔ You can keep acquiring more properties as long as they cash flow well.

👉 Bottom Line: EDSCR loans help investors scale quickly, unlike traditional financing.

✅ 4. Great for Short-Term Rentals, Renovations, and New Construction

Many lenders hesitate to fund Airbnb properties, fix-and-flip deals, or new construction loans because they require income stability. But EDSCR lenders understand that rental markets fluctuate, and they’ll often approve loans based on projected income.

This makes EDSCR financing ideal for:

✔ Short-term rentals (Airbnb, VRBO, corporate housing).

✔ Fix-and-flip investors who want to refinance after renovations.

✔ New construction properties that will become rentals.

👉 Bottom Line: If your property has rental potential, you can get financing—even if it’s not generating income yet.

✅ 5. Flexible Loan Terms & Competitive Rates

Since EDSCR loans rely on rental income, lenders view them as less risky than personal income-based loans. As a result, you can often qualify for:

✔ Higher loan amounts than with traditional stated income loans.

✔ Longer loan terms to improve cash flow.

✔ Lower interest rates than hard money or private financing.

👉 Bottom Line: Strong rental income can help you qualify for better loan terms.

The Challenges of EDSCR Loans for Stated Income Borrowers

While EDSCR loans offer great benefits, there are a few challenges to keep in mind:

❌ 1. Higher Interest Rates Than Conventional Loans

Because EDSCR loans don’t require income verification, lenders charge slightly higher interest rates to offset risk.

✔ Solution: Work with lenders who specialize in investor-friendly financing to get competitive rates.

❌ 2. Stricter Cash Flow Requirements

Most lenders require an EDSCR ratio of at least 1.0 to 1.25, meaning the property must generate enough income to comfortably cover the mortgage.

✔ Solution: Focus on high-rent areas and low-cost financing options to improve your EDSCR.

❌ 3. Larger Down Payments May Be Needed

Some EDSCR lenders require 20-30% down to ensure the loan is well-secured. This is higher than the 10-15% down required for conventional loans.

✔ Solution: Use creative financing strategies like BRRRR (Buy, Rehab, Rent, Refinance, Repeat) to recycle capital.

Who Should Consider an EDSCR Loan?

EDSCR-based financing is perfect for:

✔ Self-employed borrowers who can’t prove income via tax returns.

✔ Real estate investors who want to scale their rental portfolio.

✔ Entrepreneurs, freelancers, and gig workers who need flexible financing.

✔ Short-term rental owners (Airbnb, VRBO, etc.).

✔ Investors looking for renovation or new construction loans.

Final Verdict: Is an EDSCR Loan Right for You?

If you’re a stated income borrower who struggles to qualify for traditional financing, an EDSCR loan could be the perfect solution. Instead of worrying about W-2s, tax returns, and DTI limits, you can qualify based on rental income alone.

✔ No personal income verification required

✔ Easier approval for self-employed & investors

✔ Great for scaling your real estate portfolio

✔ Flexible financing for short-term rentals & new construction

If you have a cash-flowing property, an EDSCR-based no-income verification loan might be your best bet for expanding your real estate empire! 🚀